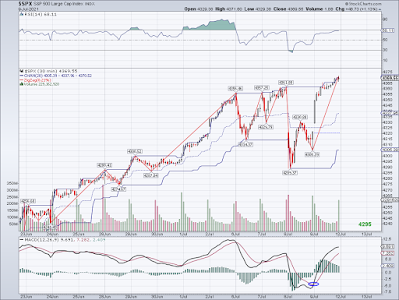

The market has continued its rally to higher highs and it doesn't seem like it wants to stop. We now have a new ATH at 4371 which are NASDAQ levels seen not all that long ago! I have stopped trying to figure out the long term count because there is no reasonable count anymore. So I am just going with the trend and trading it.

Hope everyone is enjoying the summer and staying healthy! I am hoping to go on a vacation soon but I still have some reservations despite being fully vaccinated. Just hope the Delta variant doesn't get out of control and we get more lockdowns again in the fall. Looking at the numbers, under-vaccinated regions will be suffering when it starts to cool down. Maybe the market will use this as an excuse to sell-off? I can't imagine it rallying until the end of the year but who knows at this point.

Short Term Trend = Bullish

Medium Term Trend = Bullish

For detailed wave analysis visit http://ewaveanalytics.com

* Trends are not trading signals. Trends are posted for situational awareness only and do not take into account wave counts, technical or fundamental conditions of the market. While mechanically trading the posted trends is feasible, keep in mind that these are lagging indicators and as such are prone to whipsaws and I personally do not use nor recommend them to initiate or close positions in the market without taking into consideration other factors